VEGAS CHAPTER 7

BANKRUPTCY ATTORNEYS

Are you struggling to make your payments? Our experienced Chapter 7 lawyers help you relieve your financial stress. Filing Ch 7 discharges all of your unsecured debt. It’s essential to learn the debt relief options available. Thus, if you are seeking the top rated Las Vegas Chapter 7 bankruptcy attorney… You’ve come to the right place, check out our 5 star reviews! Schedule a FREE DEBT EVALUATION today!

VEGAS CHAPTER 13

BANKRUPTCY ATTORNEYS

Filing Chapter 13 bankruptcy in Las Vegas, Nevada is the 2nd most popular choice of BK Filers in Clark County, Nevada. Additionally, filing a Chapter 13 in Las Vegas,NV immediately “stays” or stops any creditor action as the “Automatic Stay” goes into effect upon filing. Ch 13 bankruptcy fixes debt problems as: Garnishments, Foreclosure, Liens, Repossession, Bank Levies, Seizures, and creditor collection.

LAS VEGAS ZERO

DOWN BANKRUPTCY

Las Vegas Zero Down Bankruptcy services Vegas, Henderson, Summerlin, and Paradise, Nevada. Our No Money Down Bankruptcy Attorneys can file most bankruptcy petitions with no money down. No out-of-pocket expense for you. No need to save for a bankruptcy consultation. Ours Consults are Free! Plus, you don’t have to save hundreds or thousands to file bankruptcy with another attorney. Our Vegas Debt Attorneys can file you for $0.

I know what you’re thinking

“Is This Really a $0 Down Bankruptcy Filing?”

What’s the catch? How are you able to offer this? YES, THIS IS REAL! Here is how it works; First, a “skeleton” bankruptcy filing is filed for you at no charge. Next, we file the second part of your bankruptcy petition. Our Vegas bankruptcy firm charges for the 2nd part of your bankruptcy filing, however, you don’t have to start paying for your bankruptcy until 30 days after you file. Then, you make simple monthly payments to pay for your bankruptcy.

Keep in mind, even a “simple” Chapter 7 bankruptcy in Nevada is still a complex legal procedure that takes place in the federal courts. Plus, we believe that you should not try to file for bankruptcy protection without the assistance of an experienced lawyer. Therefore, our simplified “Zero Down BK” process makes it possible for people who may not be able to afford a bankruptcy attorney, now they have an option.

Call now to see if you qualify.

LAS VEGAS’S TOP LAW FIRM FOR BANKRUPTCY

Las Vegas Bankruptcy and Debt Relief Solutions are our Specialty

When you are faced with overwhelming debt in Nevada, knowing your options is the first step to taking back control of your finances. Thus, when you work with MyLasVegasLawyers, our Vegas bankruptcy law firm gives you the tools you need to determine which debt relief option best fits your situation. Contact us for an expedited debt relief needs.

Our experienced Las Vegas bankruptcy attorneys will assist you with both short term and long term solutions. Additionally, you will work directly with Las Vegas Bankruptcy Attorney Erik Severino. Plus, Erik offers free consultations, either in-person or by phone, depending on which works better for you. Also, with offices in both Henderson and Las Vegas, Nevada our bankruptcy firm is convenient for your Las Vegas debt relief needs.

Keep in mind, filing for bankruptcy in Henderson or Las Vegas is not a financial death sentence. Declaring bankruptcy doesn’t have to mean the end of your financial life. Plus, the assistance of the right bankruptcy lawyer will be beneficial as it helps you eliminate stress, resolve most of your debts, stop creditor harassment, and emerge from proceedings financially on a sound footing.

Experienced Las Vegas Bankruptcy Attorney

Also, Nevada bankruptcy lawyer Erik Severino has filed thousands of bankruptcies for people in Las Vegas, Clark County, and throughout Nevada. Additionally, Erik has a great reputation as a Las Vegas debt relief lawyer. Plus, his status is because of his dedication to his clients and his knowledge of the bankruptcy chapters, bankruptcy courts, and bankruptcy laws in Nevada. Also, Erik personally does the initial consultation with you and takes your case all the way through to discharge. Therefore, every step of the way, this dedicated Las Vegas bankruptcy attorney works with you.

Call (702) 370-0155 and speak with Erik Severino about how to eliminate your debt and how to begin rebuilding your credit after declaring bankruptcy. Remember, Initial consultations are free and can be handled in one of our area Las Vegas offices or via telephone. Your choice. Our Las Vegas bankruptcy lawyer and his team look forward to assisting you. Be it, a Las Vegas Chapter 7 bankruptcy, chapter 13 bankruptcy, Zero Down Bankruptcy, Medical Bankruptcy or an Emergency Bankruptcy filing, our Las Vegas debt relief team has you covered.

LAS VEGAS CHAPTER 7 LAWYERS

A CLEAN FINANCIAL SLATE

Filing for bankruptcy protection with our Las Vegas bankruptcy lawyer will result in a clean slate of your finances. Plus, most Chapter 7 cases provide a fresh start by eliminating debt granted by a bankruptcy discharge. Also, our professional attorneys at Vegas Bankruptcy Lawyers will do more than the filing and documentation. Therefore, an experienced attorney will guide you through the entire Chapter 7 process from beginning to end. Additionally, Vegas Bankruptcy lawyers will explain the Chapter 7 process and protect your rights as a debtor.

Plus, our experienced Las Vegas Chapter 7 bankruptcy attorney has filed thousands of bankruptcies for people in Las Vegas. Therefore, contact our law firm to find out of you qualify for Chapter 7 bankruptcy protection. Call (702) 370-0155.

WHAT IS A LAS VEGAS CHAPTER 7 BANKRUPTCY?

Las Vegas Chapter 7 bankruptcy is part of the federal bankruptcy law. Plus, having a Nevada chapter 7 bankruptcy petition approved will let you get rid of many financial obligations through a bankruptcy discharge. What this means is that you will be allowed to stop paying certain debts and in most cases will leave you debt free and ready for a “Fresh Start”

Additionally, keeping most of your personal property and alleviating debt is the principal benefit of a Nevada chapter 7 bankruptcy. Also, Chapter 7 bankruptcy stops creditors and other debt collection personnel from hounding you with collection calls. Plus, if you have judgements or garnishments, collection efforts legally have to stop once you file for chapter 7 protection in Clark County Las Vegas.

BANKRUPTCY PAYMENT PLANS FOR CHAPTER 7 BANKRUPTCY

Are you facing a situation that requires immediate attention? Are creditors harassing you and calling you all the time? Do you need your bankruptcy filed to stop a garnishment, save your home from foreclosure, or prevent a repossession? If so, we can help you TODAY!

Our Vegas Bankruptcy Team can help you, even if you don’t have any up-front money. Plus, we have Chapter 7 bankruptcy payment plans for EVERY budget. Additionally, our $0 down bankruptcy payment program allows you to file your bankruptcy with no money down and then pay the remaining fees weekly or monthly over time. We make your bankruptcy affordable for your financial situation. Therefore, Contact our Las Vegas Chapter 7 bankruptcy lawyer for more details on getting a “Fresh Start”.

LAS VEGAS BANKRUPTCY LAWYER SERVICE AREAS

LAS VEGAS CHAPTER 13 LAWYERS

LAS VEGAS DEBT RELIEF

Chapter 13 bankruptcy is the second most popular chapter of bankruptcy in Nevada. Thus, chapter 13 bankruptcy is something that may work better for people who have regular income. Additionally, filing a Chapter 13 in Nevada immediately “stays” or stops any creditor action such as: wage garnishment, repossession, foreclosure, seizure, and all creditor attempts at collection, including phone calls and letters. Whereas, our Las Vegas bankruptcy lawyer can assist.

Also, in a chapter 13 bankruptcy, a person files a plan with the federal bankruptcy court and agrees to pay all debts such as car loans, mortgage arrears, and unseen debts in an affordable monthly payment plan over a three to five-year period. Our Nevada bankruptcy lawyer works with you and stays on the case from start to finish throughout the chapter 13 filing which could take up to five years.

WHAT IS A LAS VEGAS CHAPTER 13 BANKRUPTCY?

Payments in these plans can be as low as $100 a month. Therefore, the amount of the monthly payment factors on the filer’s debt, income, assets, and situation. Keep in mind, each chapter 13 case is unique, however, our Las Vegas bankruptcy attorney can give you an approximate chapter 13 plan payment.

In a chapter 13 bankruptcy, you are able to keep the property (home, vehicle and other assets) in exchange for paying the monthly payment plan in a ch 13. Also, there are many benefits in a Chapter 13 which allows you to: pay off back taxes, save your home from foreclosure, and reduce high interest car loans. Additionally, for many people in the Las Vegas metro area, the benefits of ch 13 bankruptcy are exceptional. To learn more about the benefits of a Nevada chapter 13 bankruptcy, contact our Las Vegas bankruptcy lawyer office today.

WHAT A CHAPTER 13 BANKRUPTCY CAN DO FOR YOU

You may choose Chapter 13 Bankruptcy in Las Vegas if you have a wage garnishment, are behind on federal or state taxes, have assets that you want to protect, or are behind on your car payment. Additionally, Chapter 13 can be the best option for debt relief for Las Vegas residents who want to get back a repossessed vehicle or are facing foreclosure or are behind on a mortgage. A Chapter 13 bankruptcy repays debt per an agreed payment plan.

Additionally, in a Chapter 13 you can make up mortgage payments that you are behind. It also allows you to catch up on student loans and other necessary debts. Our experienced Vegas Chapter 13 Attorney can assist you with getting your debts wound into a Ch 13 repayment plan. Call today for a free consultation.

What Our Vegas Bankruptcy Attorney Can Do For You

Our Las Vegas bankruptcy law office is dedicated to helping the people of Nevada in times of extraordinary economic stress. Additionally, our Las Vegas bankruptcy attorneys understand that the decision to file for bankruptcy is not something to be taken lightly. Above all, declaring bankruptcy in Henderson, Las Vegas, and Clark County is difficult and can be overwhelming and an experienced Las Vegas Bankruptcy Lawyer can make all the difference when you financial freedom is on the line.

Our experienced Vegas debt relief lawyer and staff realize that you probably don’t want to file bankruptcy. Rather, you’re considering bankruptcy protection simply because it may be the best of limited options. Therefore, we will give you debt relief options and discuss with you the various options available to you. Thus, you should let our experience and unbeatable customer service guide you through to your financial freedom.

Low Cost Bankruptcy in Las Vegas

OUR 3-STEP DEBT RELIEF PROCESS

1 GET OUT OF DEBT

EXPLORE OPTION TO ELIMINATE DEBT SCHEDULE YOUR APPOINTMENT

2 ELIMINATE DEBT STRESS

STOP CREDIT HARASSMENT OUR LAS VEGAS DEBT RELIEF TEAM CAN HELP

3 IMPROVE YOUR CREDIT SCORE

WE SEE YOU THROUGH THE PROCESS FROM START TO FINISH

LAS VEGAS MEDICAL DEBT ATTORNEY

Medical Debt is the biggest reason for bankruptcy filings in Clark County. Often, medical debt is the result of an accident or some other unforeseen circumstance. However, the good news is that with the help of our Las Vegas bankruptcy attorneys, you can eliminate your medical debt through one of our debt relief options.

Sometimes you may need to file for a medical bankruptcy as a result of out-of-control doctor and medical bills. Though these debts were not voluntary nor any fault of your own, they still must be paid by you or discharged by filing for bankruptcy.

EMERGENCY BANKRUPTCY FILINGS IN LAS VEGAS

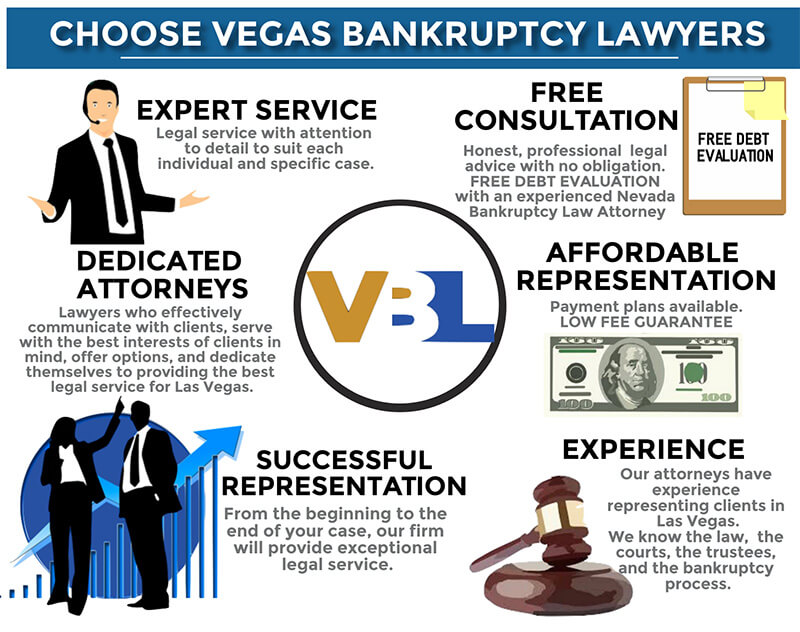

WHY CHOOSE VEGAS BANKRUPTCY LAWYERS

Our goal is to provide you with your Nevada debt relief options. In addition, our Las Vegas bankruptcy lawyers will determine if chapter 7 bankruptcy or chapter 13 bankruptcy may be in your best interest. Also, we want to make sure that filing for bankruptcy protection in Nevada is the most beneficial option available to you and your family. Please note, our initial bankruptcy consults are free and can be done either in one of our Las Vegas area bankruptcy offices or over the phone. Therefore, our legal firm provides a cheap and affordable Las Vegas Bankruptcy Lawyer, and experienced and knowledgable Las Vegas legal representation.

VEGAS BANKRUPTCY LAWYERS OFFICE

Las Vegas

7251 W Lake Mead BLVD #300

Las Vegas, NV89128

Henderson

1489 W Warm Springs Rd. Ste 110

Henderson, NV 89014

LAS VEGAS BANKRUPTCY BLOGS

What Happens To a Credit Score After Filing Bankruptcy?

Let Our Las Vegas Bankruptcy lawyer Help You. Most people believe that after filing for bankruptcy their credit score will drop drastically. This, however, is not entirely true. People filing for bankruptcy are usually already in financial hard times. When a debtor already has a low credit score, the bankruptcy filer will see a significant increase within the first 12 months after filing for bankruptcy protection in Nevada.

What is a Chapter 20 Bankruptcy?

Our Las Vegas Bankruptcy Lawyer Explains

Therefore, imagine filing for a Chapter 7 bankruptcy and then having an unexpected emergency that results in thousands of dollars of debt. Most people are under the assumption that if they filed a Chapter 7 bankruptcy less than eight years ago they do not have the option of filing bankruptcy again.

Toys R Us is Closing all Nevada and U.S. Stores

Unable to Survive Chapter 11 BankruptcyToys R Us is unable to survive Chapter 11 Bankruptcy. On Friday, June 29, 2018, the end of a legacy in the toy industry will close its doors for the final time. After 70 years in business, Toys R Us will be no more. Despite a last ditch effort in September 2017, the toy chain was unable to reorganize its debts in a Chapter 11 Bankruptcy to keep its doors open.